working capital turnover ratio interpretation

A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue. The company is able to generate Revenue which is as high as 20 times the Average Working Capital.

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business.

. The working capital turnover ratio equals net sales for the year -- or sales minus refunds and discounts -- divided by average working capital. A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales. Interpreting Working Capital Ratio A company with a very low working capital ratio is at risk of bankruptcy.

Working capital is very essential for the business. SIMPLE CORRELATION ANALYSIS BETWEEN SELECTED RATIOS RELATING TO WORKING CAPITAL MANAGEMENT AND PROFITABILITY Year CR LR WTR ITR DTR CTR ROI 2005 208 187 229 1295 214 15469 051 2006 235 208 194 1175 193. A company with too high a ratio is not doing enough to put its assets to work.

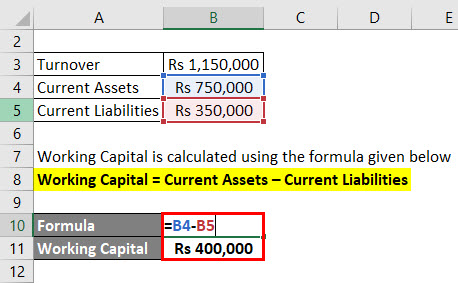

This gap is bridge with bank borrowings and long term sources of funds. It is a measure of the ability of a business to use its working capital to support its turnover or revenues. Working capital is current assets minus current liabilities.

Working Capital Turnover Ratio Formula. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale.

In this formula working capital refers to the operating capital that a company uses in day-to-day operations. Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales. Working Capital Turnover Average Working CapitalNet Annual Sales where.

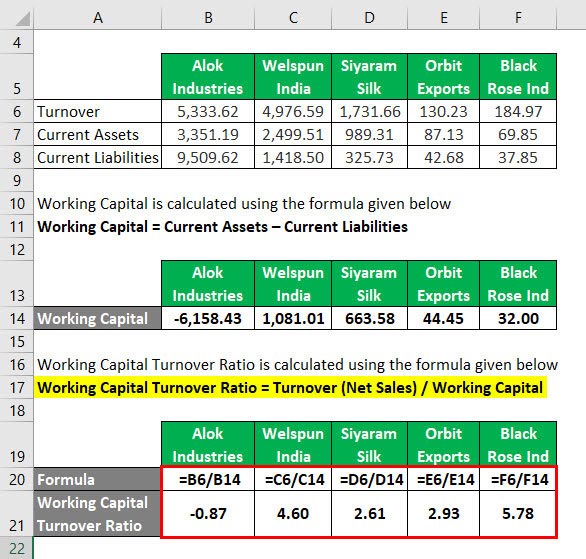

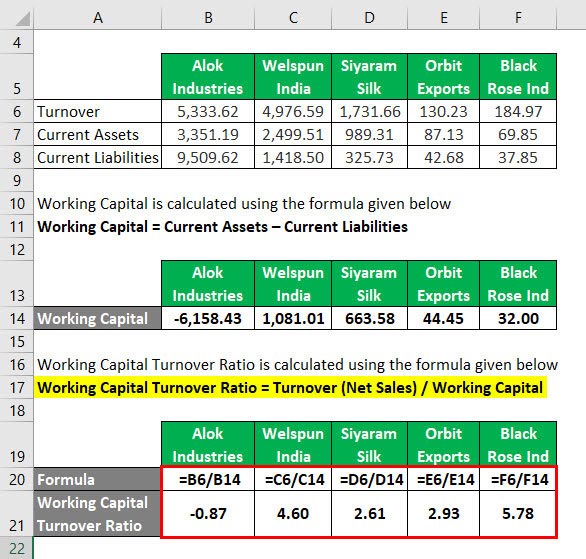

Working capital turnover ratio Net Sales Average working capital Company A 1800340 20x Company B 2850 -180 -158x What this means is that Company A was more efficient in generating Revenue by utilizing its working capital. The formula consists of two components net sales and average working capital. Working Capital Turnover Ratio is a financial ratio which shows how efficiently a company is utilizing its working capital to generate revenue.

Average working capital equals working capital at the beginning of the year plus working capital at year-end divided by 2. Formula For Working Capital Turnover Ratio Working Capital Turnover Ratio Turnover Net Sales. The ratio is very useful in understanding the health of a company.

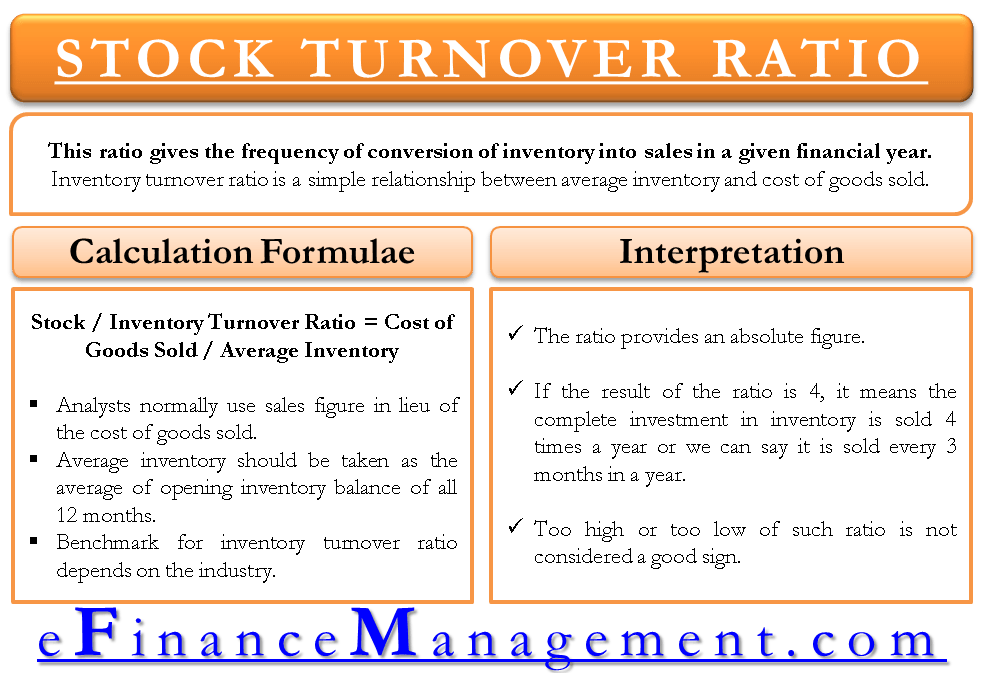

Working capital turnover ratio is computed by dividing the net sales by average working capital. We calculate it by dividing revenue by the average working capital. It measures how efficiently a business turns its working capital into increase sales.

Working capital turnover ratio Cost of sales Average net working capital Where cost of sales Opening stock Net purchases Direct expends - Closing stock Net working capital Current assets - Current liabilities Average of networking capital is. It is defined as the difference between the current assets and current liabilities and working capital turnover ratio establishes. The Working Capital Turnover Ratio is also called Net Sales to Working Capital.

Click to see full answer. The working capital turnover ratio is a ratio of the turnover of the business to its working capital. Working capital turnover This ratio measures how efficiently a company is at utilizing its working capital to generate sales.

In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to generate revenues from operations. It indicates that for one rupee of sales the company needs Rs 025 of its net current assets. A company with a higher working capital turnover ratio would be more efficient while a company with a lower working capital turnover ratio would be less efficient ie more inefficient.

The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. The working capital turnover ratio shows the companys ability to pay its current liabilities with its current assets. The working capital of a company is the difference between the current assets and current liabilities of a company.

There is a moderate negative correlation between cash turnover ratio and profitability of - 0485The high turnover of TABLE - 2. Net annual sales is the sum of a companys gross sales minus its returns allowances and discounts over the course of a. Working Capital Turnover Ratio is the ratio of net sales to working capital.

Net Working Capital Turnover Sales Net Current Assets 40000 10000 4 times The reciprocal of the ratio will become 025 that is the reciprocal of 41 is 14. This ratio shows the relationship between the funds used to finance the companys operations and the revenues a company generates in return. The formula for calculating this ratio is by dividing the sales of the company by the working capital of the.

How do you interpret working capital turnover ratio. This ratio demonstrates a companys ability to use its working capital to generate income. It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time.

The goal then is to find a company whose asset ratio reflects an ability to immediately meet all current liabilities but just barely in most cases. Working capital is the asset base after taking into account liabilities. The working capital turnover is a ratio to quantify the proportion of net sales to working capital.

Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. The ratio can be used to evaluate the efficiency of a. Working Capital Turnover Ratio is used to do an analysis of the utilization of short term resources for sales.

It signifies that how well a company is generating its sales with respect to the working capital of the company. Working capital turnover ratio is a formula that calculates how efficiently a company uses working capital to generate sales.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Efinancemanagement Com

Stock Inventory Turnover Ratio Calculate Formula Benchmark

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Ratio Interpretation Financial Ratio

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Asset Turnover Ratio Formula And Excel Calculator